How one bank’s collapse left health start-ups feeling bereft

While Silicon Valley Bank (SVB) was fighting to raise capital or find a buyer last week, Hunter was on a flight from Las Vegas to Vancouver, Canada. By the time he landed three hours later, SVB had been shut down and taken over by US regulators after what’s been described as the first Twitter-fuelled bank run.

The collapse, the biggest bank failure in the US since the 2008 financial crisis, has sent shockwaves across the tech sector, which SVB had catered to for four decades.

While the US federal government has stepped in to assure its clients would have access to their full deposits, entrepreneurs worry that the bank’s downfall will leave a big void and that cash to finance their ventures may dry up.

Founded in 1983, SVB had established itself as the go-to lender for US start-ups viewed as too risky by more traditional banks. As of last year, it did business with nearly half of all venture-backed tech and life science companies in the US.

“These guys specifically focused on the small and emerging companies, and they were the heavyweight in that space,” Hunter told Euronews Next.

“There are little ones here and there, but they had the broadest reach. So it's a blow, and it's going to have an impact for some time to come”.

A special bank

The life sciences and healthcare industry relied heavily on SVB, with about 12 per cent of the bank’s $173 billion (€161 billion) in deposits belonging to companies in that sector.

Nine in 10 start-ups fail within 10 years, and pharma and health tech in particular is an inherently risky business. So when founders go around looking for people to put their faith and money into their ideas, things can get tricky.

With his previous start-up, a speciality pharmaceutical company in Switzerland, Hunter said he struggled to simply open a corporate bank account.

“A lot of banks don't want your money, even a decent amount of money. With $25-30 million [€23-28 million], you'd think: no problem opening a bank account. You'd be surprised,” he said.

“You're not making any money when you're starting out, so you're constantly drawing down, you're not adding in. So they're like: ‘you know what? I just don't need this hassle’”.

That’s where having SVB made a real difference; by providing young entrepreneurs with a bank account and precious support to get started, hire a team, set up payroll and dream big.

SVB lent these founders money, including when their companies didn’t have a positive cash flow yet, and helped them raise equity early on.

“They were kind of the central bank that connected venture capitalists to entrepreneurs. That's where you want to go. If you're trying to raise money and you want to go to a conference and meet 100 investors, not five investors, that's the place to go,” Hunter said.

Funding gap

The irony with the collapse of tech’s beloved bank is that it was largely fuelled by tech itself - from digital banking making money transfers much easier to panic spreading on social media and in private WhatsApp chat groups.

SVB customers withdrew $42 billion (€39 billion) in a single day last week, leaving the bank with nearly $1 billion (€930 million) in negative cash balance, according to a regulatory filing.

Many entrepreneurs said that the bank’s struggles posed an existential threat to their own business - the one they’d worked so hard to build - and they were terrified at the idea of no longer being able to pay their staff and invoices.

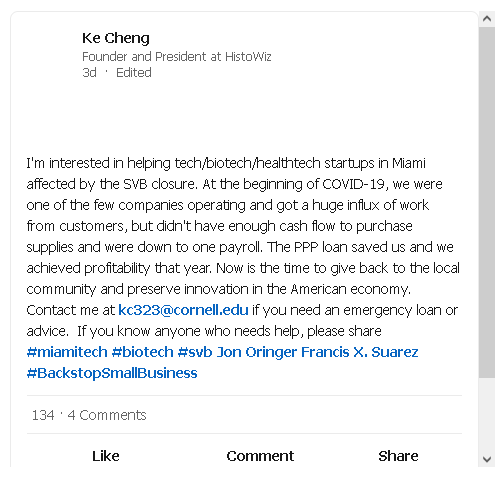

“I was shocked. My sister’s bank was SVB, she had around $2 million (€1.9 million) in there. She was very worried, I helped her open another bank account over the weekend,” said Ke Cheng, founder and president of HistoWiz, a biotech company that automates the processing and digitising of tissue samples for pharma and academia.

Since her own company’s deposits were mostly safe outside of SVB, Cheng took to LinkedIn to offer her help to affected start-ups in her area, Miami.

She explained that at the height of the COVID-19 pandemic, the Trump administration’s exceptional Paycheck Protection Program had saved her company, which became profitable, and now was “the time to give back to the local community and preserve innovation in the American economy”.

Hunter, whose medtech company Canary Medical had around $5 million (€46 million) in cash exposed at SVB, was of course relieved when US regulators announced that all deposits at SVB would be guaranteed. But he’s uneasy about seeing a valued partner go down.

“Yes, we have access to our capital and that's great. But, you know, we didn't just bank with them. We're working on different M&A deals right now, and they were providing those services for us, too,” he said.

“So the cash is one thing, but the services and the other things - those will be missed if there's not some way to keep them going”.

Cheng said she hoped the US government could still “somehow encourage these local and smaller start-up-friendly banks to continue,” because she was very worried about the outlook for early venture capital funding in health tech start-ups this year.

“I think VCs will be very careful writing checks now. Because of the interest rate hikes and crypto fallout, I’m sure people are pretty freaked out about investing money in startups,” she said.

‘High reward requires high risk’

At the moment, it’s unclear if any institution can or will fill the void left by SVB when it comes to funding start-ups.

“There are other banks that do these services, don't get me wrong. But this was the 800-pound gorilla of the banks that did that,” Hunter said. “So, I'm sure in time, one of the other companies will emerge to take that space. But it will take time. It will not be in a year or two years”.

A partner at a rival European venture debt provider told Euronews Next that SVB had done “a formidable job of serving the tech and healthcare ecosystem,” including in Europe where it’s been active for around 15 years.

“It's of course very unfortunate when a player of such scale disappears. Obviously, it leaves a funding gap,” said the partner, who asked not to be identified because his company both collaborated and competed with SVB on the continent.

He welcomed the British government’s swift intervention to arrange a deal for HSBC to take over the UK arm of SVB in a bid to protect the country’s tech sector from a cash crunch.

“I think on both sides of the Atlantic, there is a realisation that the tech and healthcare ecosystem is fundamental for the growth economy and fundamental for the survival of the overall economy,” the partner said.

“They needed to do whatever they could to make sure that the ecosystem survives and does not get affected by one bank's issues. But it remains to be seen how they continue providing finance”.

‘Live by the sword, die by the sword’

In a way, the collapse may put the US tech sector on more of a par with the tech sector in Europe, which experts say has no real equivalent to SVB in either scale or specialisation.

In the EU, banks of that size are typically more diversified and more strictly regulated than in the US, and there’s often a domestic bias at play too, with German companies, say, more easily banking with the likes of Deutsche Bank.

“The benefits of the European and the Canadian system are that capital is more dispersed and risk-taking is more measured. The disadvantage of that is that high reward requires high risk,” Hunter said.

“The Americans have always embraced risk and pushing the edge. And no place on Earth for the last 30 years was that more evident than Silicon Valley, right? So, I guess it's a little bit of ‘live by the sword, die by the sword’.

“We [in Canada and Europe] take a more cautious approach and our companies tend to be slower emerging and tend not to scale the heights as quickly. Americans take a much more aggressive approach and they seem to incubate more successful companies,” he added.

But on both sides of the Atlantic, tech entrepreneurs and backers are left feeling jittery.

SVB’s collapse risks further spooking investors who had already become “a little bit more pessimistic about technology, about start-ups, about innovation” in recent months, said Antonio Fatas, Professor of Economics at INSEAD business school in France.

“I just think things are going to be harder. Funding is going to become a little bit more conservative for sure,” he said.