First Republic auction underway, with deal expected by Sunday

Citizens Financial Group Inc (CFG.N), PNC Financial Services Group (PNC.N) and JPMorgan Chase & Co (JPM.N) are among bidders vying for First Republic in an auction process being run by the Federal Deposit Insurance Corp, according to sources familiar with the matter. US Bancorp (USB.N) was also among banks the FDIC had asked to submit a bid, according to Bloomberg.

Guggenheim Securities is advising the FDIC, two sources familiar with the matter said.

The FDIC process kicked off this week, three of the sources said. The bidders were asked to give non-binding offers by Friday and were studying First Republic's books over the weekend, one of the sources said.

A deal is expected to be announced on Sunday night before Asian markets open, with the regulator likely to say at the same time that it had seized the lender, three of the sources said.

US Bancorp did not immediately respond to a request for comment. First Republic, the FDIC, Guggenheim and the other banks declined to comment.

DIFFICULT DEAL

A deal for First Republic would come less then two months after Silicon Valley Bank and Signature Bank failed amid a deposit flight from U.S. lenders, forcing the Federal Reserve to step in with emergency measures to stabilize markets.

While markets have since calmed, a deal for First Republic would be closely watched for the amount of support the government has to provide.

The FDIC officially insures deposits up to $250,000. But fearing further bank runs, regulators took the exceptional step of insuring all deposits at both Silicon Valley Bank and Signature.

It remains to be seen whether regulators would have to do so at First Republic as well. They would need approval by the Treasury secretary, the president and super-majorities of the boards of the Federal Reserve and the FDIC.

In trying to find a buyer before closing the bank, the FDIC is turning to some of the largest U.S. lenders.

JPMorgan already holds more than 10% of the nation’s total bank deposits and would need a special government waiver to add more.

"For a large bank to buy all or most of the bank could be healthier for First Republic customers because it could put them on a broader and more stable platform," said Eugene Flood, president of A Cappella Partners, who serves as an independent director at First Citizens BancShares and Janus Henderson and was speaking in a personal capacity. First Citizens agreed to buy failed Silicon Valley Bank last month.

STUNNING FALL

First Republic was founded in 1985 by James "Jim" Herbert, son of a community banker in Ohio. Merrill Lynch acquired the bank in 2007, but it was listed in the stock market again in 2010 after being sold by Merrill's new owner, Bank of America Corp (BAC.N), following the 2008 financial crisis.

For years, First Republic lured high-net-worth customers with preferential rates on mortgages and loans. This strategy made it more vulnerable than regional lenders with less-affluent customers. The bank had a high level of uninsured deposits, amounting to 68% of assets.

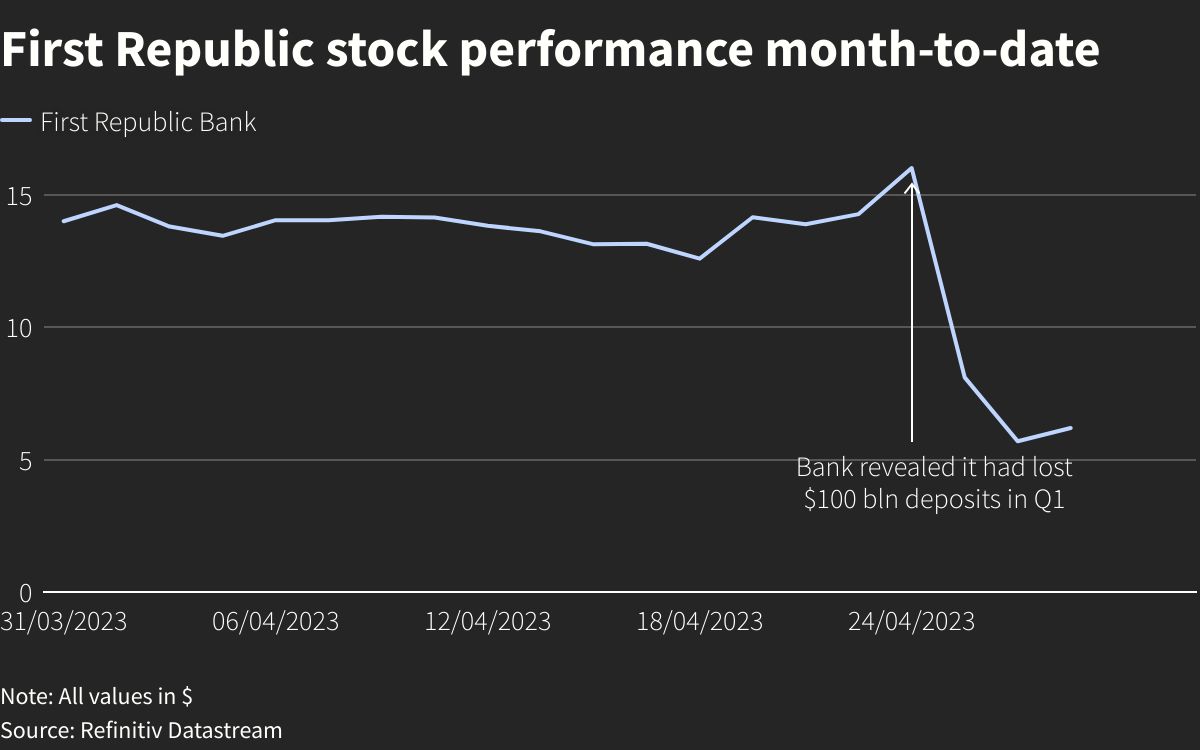

The San Francisco-based lender saw more than $100 billion in deposits fleeing in the first quarter, leaving it scrambling to raise money.

Despite an initial $30 billion lifeline from 11 Wall Street banks in March, the efforts proved futile, in part because buyers balked at the prospect of having to realize large losses on its loan book.

A source familiar with the situation told Reuters on Friday that the FDIC decided the lender's position had deteriorated and there was no more time to pursue a rescue through the private sector.

By Friday, First Republic's market value had hit a low of $557 million, down from its peak of $40 billion in November 2021.

Shares of some other regional banks also fell on Friday, as it became clear that First Republic was headed for an FDIC receivership, with PacWest Bancorp (PACW.O) down 2% after the bell and Western Alliance (WAL.N) down 0.7%.