Stocks had a wild start to the year. Investors should be careful

Welcome to the second quarter, where Wall Street strategists say the trends that defined the first three months of the year will remain influential.

"The start of 2021 is indicating what we expect for the full year," said Jeffrey Sacks, head of investment strategy in Europe, the Middle East and Africa for Citi Private Bank.

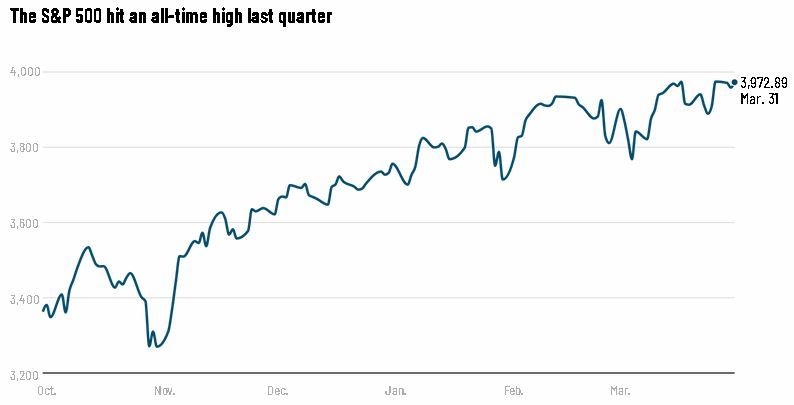

Overall, the stock market performed well between January and March. The S&P 500 gained 5.8%, closing out Wednesday near a record high. The Dow Jones Industrial Average rose 7.8%, while the Nasdaq Composite climbed a more modest 2.8%.

But day-to-day, pockets of turbulence kept cropping up. Speculative behavior was on display across markets, as investors backed meme stocks like GameStop, pumped billions of dollars into "blank check" acquisition firms and snapped up digital art with non-fungible tokens, or NFTs.

Sacks expects more examples of this in the second quarter, given that investors will remain flush with cash as governments and central banks continue to provide stimulus.

"There's [a] lot of liquidity looking to be invested," Sacks told me. "That's likely to continue because we know central banks are intent on keeping rates low."

The clout of retail investors, he added, is "here to stay," given unprecedented access to trading platforms and the ability to coordinate online. That means the hype around GameStop (GME), which has seen shares leap 908% this year thanks in part to enthusiasm on social media, may not be an isolated incident.

Concerns about rising inflation — which have sparked a sell-off in government bonds, pushing up yields — are also expected to remain a feature on Wall Street, especially as lawmakers debate another massive spending package on jobs and infrastructure proposed by President Joe Biden.

Sacks said Citi expects the yield on the benchmark US 10-year yield, which started the year at roughly 0.9%, to reach 2.5% over the course of 2021. If it moves upward gradually, markets should have time to adjust. But a sharp jump could rattle investors, sparking another flight from high-growth tech stocks, which perform better when rates are lower.

"Investors need to be on guard," David Bianco, chief investment officer for the Americas at DWS, told me. "The risk is [yields] move up faster than our expectations."

Then, of course, there's Covid-19, which continues to hit economies around the world even as vaccination campaigns pick up in countries like the United States and the United Kingdom. France announced tougher restrictions on Wednesday, as President Emmanuel Macron warned that the country risked "losing control" over the virus.

Sacks said the threat of negative developments, including new coronavirus variants, needs to remain on investors' radars.

His message: There's still money to be made in the bull market. But heading into the second quarter, there's a "need for selectivity," Sacks said, with volatility ensuring that not every investment opportunity will be a winner.

Top businesses condemn Georgia election law

Companies based in Georgia are condemning a new election law in Georgia after coming under heavy pressure from activists.

The battle lines: Republican Gov. Brian Kemp recently signed a law that introduces new impediments to voting, reducing the number of ballot drop boxes in heavily African American areas, and allowing the state to intervene to assert control over the conduct of elections in Democratic counties.

It also shortens the time available for absentee votes and introduces new registration requirements that critics say are designed to target Black voters.

Huge employers in the Atlanta area, including Delta Air Lines and Coca-Cola, stand accused of not doing enough to defeat the bill and are now facing calls for boycotts, my CNN Business colleague Chris Isidore reports.

With pressure building, the companies are criticizing the law.

"I need to make it crystal clear that the final bill is unacceptable and does not match Delta's values," Delta CEO Ed Bastian told employees on Wednesday.

"After having time to now fully understand all that is in the bill, coupled with discussions with leaders and employees in the Black community, it's evident that the bill includes provisions that will make it harder for many underrepresented voters, particularly Black voters, to exercise their constitutional right to elect their representatives. That is wrong."

Coca-Cola, which had previously put out a statement saying it was "disappointed" in the legislation and that it would advocate for changes, ramped up its rhetoric Wednesday, when CEO James Quincey called it "unacceptable" and "a step backwards."

But the controversy isn't going away. Kemp quickly hit back at Bastian, claiming his statement "stands in stark contrast to our conversations with the company, ignores the content of the new law, and unfortunately continues to spread the same false attacks being repeated by partisan activists."

Big picture: Companies are increasingly being called upon to take a stand on political and social issues important to their customers and employees.

"These organizations are sensitive to their public relations," said Maurice Schweitzer, a business professor at the University of Pennsylvania. "They don't want to lose even a handful of customers for something that has nothing to do with their business."

Janet Yellen is cracking down on hedge funds

US financial regulators are intensifying their oversight of hedge funds as concern grows about their high levels of debt.

Treasury Secretary Janet Yellen just announced that the Financial Stability Oversight Council has relaunched a working group focused on hedge funds that will identify risks, share data and work to strengthen the financial system, my CNN Business colleague Matt Egan reports.

"The pandemic showed that leverage of some hedge funds can amplify stresses," Yellen said in prepared remarks during her first meeting at the helm of the FSOC.

The meeting comes just days after the implosion of Archegos Capital, a little-known hedge fund operating as a family office that caused shockwaves on Wall Street and sizable losses for some big banks. The fiasco boosted calls for regulators to apply more scrutiny to dark corners of the market.

"Regulators need to rely on more than luck to fend off risks to the financial system," Sen. Elizabeth Warren, a Democrat from Massachusetts, said in a statement to CNN Business. "We need transparency and strong oversight to ensure that the next hedge fund blowup doesn't take the economy down with it."

Yellen also signaled a new focus on the climate crisis, including market and credit risks from climate-related events and an accelerating transition to a net-zero economy.

"We cannot only look back and learn the lessons of last year. We must also look ahead, at emerging risks. Climate change is obviously the big one," Yellen said. "It is an existential threat to our environment, and it poses a tremendous risk to our country's financial stability."