Hungary Holds Key Rate After Currency Tumbles on EU Fund Risk

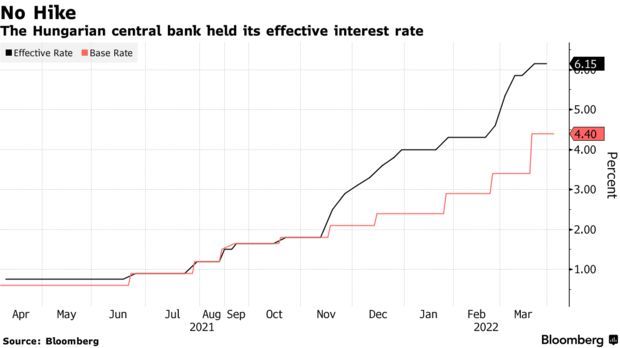

The one-week deposit rate remained at 6.15% on Thursday in the first rate decision following Prime Minister Viktor Orban’s election victory over the weekend. The central bank uses this facility -- where commercial banks park most of their free cash -- to react to short-term financial tensions, including swings in the forint.

The forint has declined 3.2% against the euro in the last week, making it the worst performer in the world, as the prospect of the EU withholding funds and an emboldened Orban plugging holes in the budget with unorthodox measures spooked investors. On Wednesday, Orban said he may consider a tax on windfall profits.

Hungary will publish inflation data for March on Friday, and analysts expect price growth to surge to 8.8% from a year earlier. The central bank indicated it will keep raising rates until inflation is on track to slow to its 3%. Money market traders increased their bets on further rate hikes by 25 basis points this week.